Corporate Tax Registration: Why you need to apply

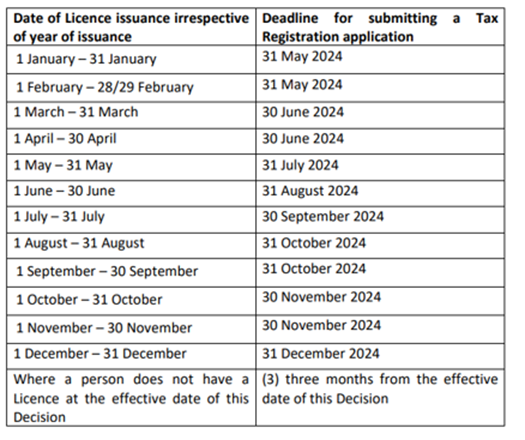

Regarding the new Corporate Tax Registration deadlines, we would like to inform you on the following important details:

In accordance with Federal Tax Authority (FTA) Decision No. 3 of 2024, companies are required to register for Corporate Tax. The registration deadline varies depending on the company’s incorporation date, as outlined below:

Who is exempt from UAE Corporate Tax?

The following persons are exempt from UAE CT, either automatically or by way of application:

- The UAE Federal and Emirate Governments and their departments, authorities and other public institutions;

- Wholly Government-owned companies that carry out a mandated activity, and that are listed in a Cabinet Decision;

- Businesses engaged in the extraction of UAE natural resources and related non-extractive activities that are subject to Emirate-level taxation after meeting certain conditions;

- Public Benefit Entities that are listed in a Cabinet Decision;

- Investment Funds that meet the prescribed conditions;

- Public or private pension or social security funds that meet certain conditions; and

- UAE juridical persons that are wholly owned and controlled by certain exempted entities after meeting certain conditions.

Important Reminder regarding Corporate Tax:

- Not registering for Corporate Tax on time may lead to an AED 10,000

- Even if your company is not VAT compliant, you are still required to register for Corporate Tax

- Corporate Tax Registration is required regardless of whether your company is registered in a free zone or on the DED mainland.

Ensure your company is compliant with Corporate Tax. We can assist you with Corporate Tax registrations.

Note: Estimated Time to Complete Application by the FTA: 20 business days from the date the completed application was received by the FTA. However, in case where any additional information is needed, FTA may take additional time to process the application. The applicant needs to provide the additional information and re-submit the application. It may take the FTA a further 20 business days to respond to the updated application. If the application is not resubmitted within 60 calendar days from the date you received the notification from FTA, the application shall be rejected.

We are here to help:

Whether you’re an individual or a company, our team of experts is ready to help you find the perfect solution to meet your unique needs.

Get a free consultation now!

Here are the following links related to this article:

Get in touch with us!

Contact us now!

Google Reviews:

Become our next success story. Start today!